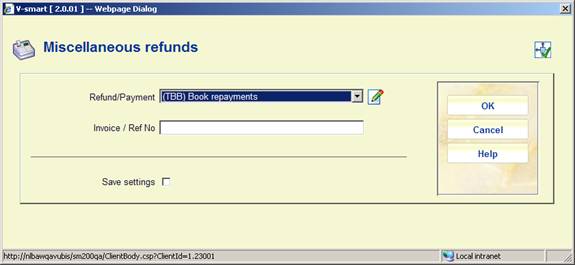

When you select this option, providing categories for free refund payments have been defined in AFO 494, a form will be displayed. These categories are used to include the free refund payments in the cash register overviews.

Refund/Payment: Select a category from the dropdown list of defined categories.

Invoice / Ref No: Depending on parameters in AFO 494 – Options for Misc. payments and refunds, you may also see a field here for inputting a reference or invoice number (as free text).

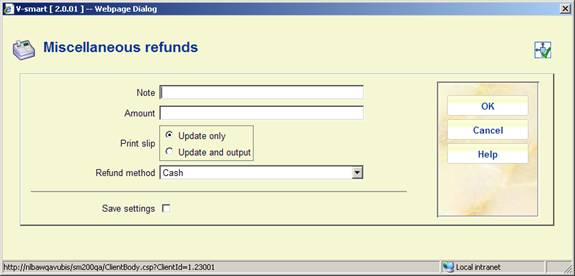

After clicking , the next input form is displayed:

Note: Enter a note here concerning the refund. Using 494, entering a note can be made mandatory. The note may contain a maximum of 25 characters.

Amount: Enter the amount being refunded.

Print slip: Indicate here whether or not the system is to print a slip.

Refund method: Depending on parameters in AFO 494 – Options for Misc. payments and refunds, you may also see a dropdown list here for valid refund types.

When you select this option, providing categories for free receipts have been defined in AFO 494, a survey screen will be displayed. These categories are used to include the free receipts in the cash register overviews. The method used for this option is the same as that for 'Miscellaneous refunds'.

Also consult the general help on this subject for background information.

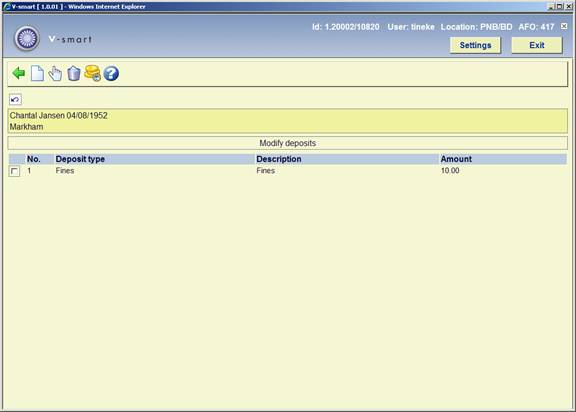

After choosing this option and the borrower has a deposit, an overview screen will be displayed.

When you choose the “Modify deposit” icon, a screen displays containing a protected window containing the borrower's name and address and a list (grid) of deposits that the borrower currently has including the deposit's code, brief description and current amount.

: Choose this option to add a new deposit. See section 417.6.1.

: This option is used to increase the amount of the deposit. You can only add money to deposits whose usage restrictions contain the current institution/location within their scope. For example, a borrower at PNB/BD can add money to his deposit that has usage restriction of PNB/* but cannot add money to his deposit that has usage restriction of TST/BR1. The borrower would have to physically go to TST/BR1 to add money to the second deposit.

If you are not allowed to add money to the deposit, the system displays a message.

:Use the delete icon to delete the selected deposit. A deposit can be deleted only if the deposit balance is 0 or less than zero.

: Choose this option to (partially) refund the deposit. See section 4.17.6.2.

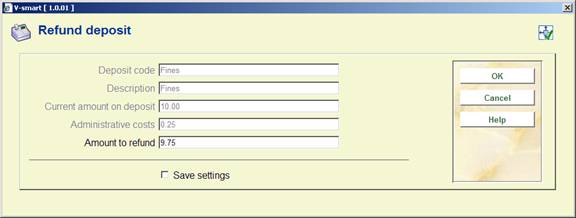

After choosing this option the following form will be displayed:

Choose a valid deposit type. These codes are defined in AFO 481 – Deposits – Deposit codes. Next, an input screen is displayed:

Deposit code, Description and Current amount on deposit are protected fields.

Amount to add: The amount to add field must be greater than the amount defined as the minimum amount of positive deposit change and must be greater than the minimum total amount of deposit (these amounts are defined in AFO 481 – Deposit codes).

Borrower who pays deposit: This field may be protected, may be limited to a list of related borrowers (with the specific relation type(s) defined in the deposit code record) or the borrower may be displayed along with a search button.

Payment code: Choose a payment code from the dropdown list. These codes are defined in AFO 481 – Deposits – Valid payment types.

The ability to refund cash from deposit accounts is a restricted function. In AFO611 –Passwords – Login restrictions – Borrowers and Loans (continued), there is an option, Refund deposits, that restricts users from using the Refund option on the Modify deposits screen. If you attempt to refund and you are a restricted user, a warning message is shown.

If you are allowed to refund and the deposit is still valid for your borrower category and if, within the usage restriction scope of the deposit, there is at least one institution/location set-up for your borrower category that is in-use and the usage restrictions contain the current institution/location, a form displays containing the following fields:

Deposit code, Description and Current amount on deposit are protected fields.

Administrative costs: protected. Defaults to the amount defined in the Deposit code record. It is never more than "Current amount on deposit".

Amount to refund: free text. Automatically defaults to the (current amount – administrative charge). This is the maximum amount that the borrower can get back. If the Allow partial refunds flag is not set in the Deposit code, this is the only acceptable amount for the borrower to get back.

Note

If the deposit is no longer defined or is not in-use for the borrower category, all of the money is refunded back to the borrower. The deposit is removed from the borrower's list of deposits.

Note

You are only able to refund money from deposits whose usage restrictions contain the current institution/location within their scope. For example, a borrower at PNB/BD can get money refunded from his deposit that has usage restriction of PNB/* but cannot refund money from his deposit that has usage restriction of TST/BR1. The borrower has to physically go to TST/BR1 to refund money out of the second deposit.

· Document control - Change History

|

Version |

Date |

Change description |

Author |

|

1.0 |

May 2008 |

creation |

|

|

2.0 |

October 2009 |

new option to add invoice/reference number; new option to define the payment method |

|